Actually, it was to Jekyll Island, Georgia… to be precise.

And how apt did that name turn out to be? And if a bunch of thieving Banksters hiring a steam train to take them on a clandestine ride under the cloak of darkness sounds decidedly eerie, then it damn well should.

The exact location was a club and a mansion on this island just off the coast of Georgia.

It turned out that the creatures that attended this meeting ended up creating the equivalent of a financial Frankenstein monster that would prey, not only on the US but eventually on the economy of the entire world. This would feather the nests of these already wealthy beyond belief attendees, their families, and their corporate cronies for the next century.

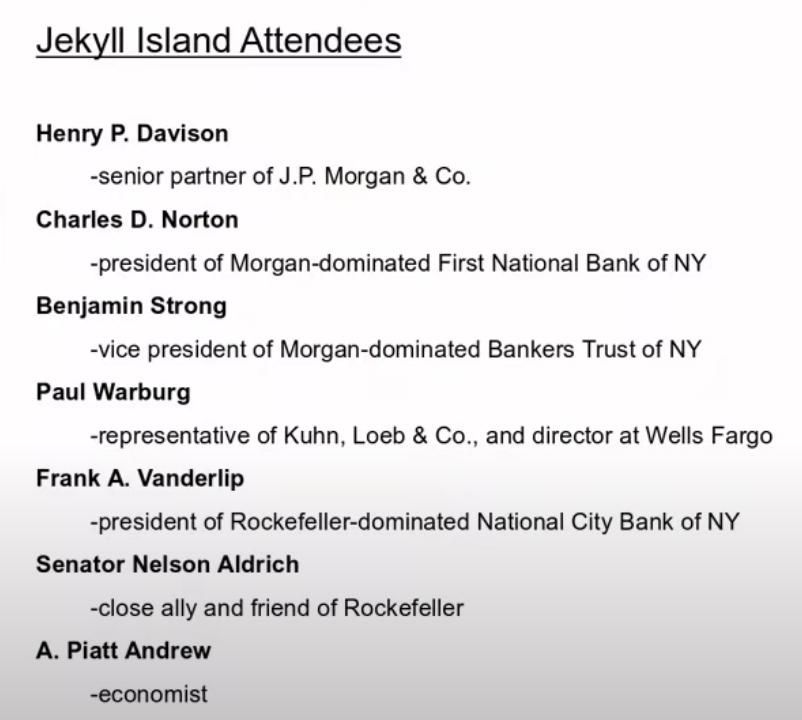

And the attendees…

Talk about a who’s who of the financial heavyweights!

The First National Bank of NY was in the JP Morgan orbit. Benjamin Strong was also a partner of JP Morgan. Vanderlip was head honcho of what we now know as Citibank. Aldrich was the father in law of John D Rockefeller Junior and head of the National Monetary Commission. Piatt was the obligatory University academic in attendance.

It took me twenty years to find out which particular banks were GIVEN the FED ownership and it turns out that ~75% of the shares in the New York FED ended up falling directly into the hands of JP Morgan and Citibank! At the time these seven men represented around 25% of the entire world’s wealth. It hardly should need reminding anyone here that not a single share was ever owned by the US Govt.

These Banksters were terrified that the press, who actually did their job of real journalism back in the day, would get wind of this meeting. If this meeting had been exposed as this group of plutocrats devising a new central bank model then there is no way this plan would have ever been successful and the US Central Bank would never have ended up in private hands.

This had to be kept well away from the court of public opinion and it was passed off as a duck hunting expedition. They took very strict precautions, boarding the private rail car in New Jersey using code names and making damn sure there were no reporters anywhere near the scene. The meeting on the island lasted 10 days in order to forge their cunning plan.

And why am I talking about this event in 1910 and what on earth does this have to do with Putin’s put and the watershed in global finance in the last two weeks. Well, how about the fact that it actually spells the death of 3 massive financial constructs that have sucked the lifeblood out of the world’s economy for more than a century. In fact, arguably more happened this month in terms of a major paradigm shift in global finance than in the previous 112 years.

This exciting new development spells the end of the FED, if not in terms of its very survival as a 100% privately owned CB model, then at the very least as the conduit that links the entire US financial system to the private Central Bank of Central Banks the BIS.

This is pretty much literally the head of the beast and is located in Basel Switzerland. By definition, this includes the beginning of a major dismemberment of the strong link between Wall Street and the old money of Europe… The City of London, Threadneedle Street, and the old kleptocratic families of Western Europe.

What does this separation involve?

- The survival of the FED privately owned central bank model

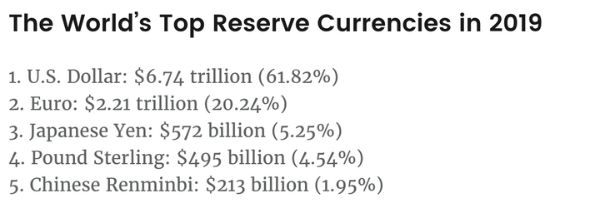

- The survival of the US dollar as the overwhelmingly dominant reserve currency

- The survival of the US dollar as the global default currency [in other words the currency you flee to when things look like they might just go tits up… even if the crisis is smack in the heart of the US… think Lehman’s 2008]

- The ability of the US to almost endlessly sell its debt globally

- The end of the Petrodollar… a construct that was supposed to give what was essentially fiat fairy tale currency a notion of tangibility and backing

And how on earth does all of this relate to Mr Brash’s interview…

We have an ex RBNZ Governor commenting on the incumbent’s performance and demonstrating that neither has the faintest clue that the old system is gone for all money [so to speak]… and good riddance too… even if the birthing of a new system is guaranteed to be extremely painful.

If we all stay with the default meme that the US is the financial centre of the world when in reality it is a zombie economy we WILL hitch the NZ economy to the wrong wagon and as a country will suffer the dire consequences. Obviously, the twaddle that we hear from Mr Orr is precisely what we would expect simply because he has no choice but to parrot the BIS club narrative.

Mr Brash reminds us too in his interview that the club roots run deep, Hotel California style, in fact. And thanks for reminding the readers here that you both appear to miss every single elephant in the room… especially the largest one of all… the fact that the western privately owned banking cabal with its debt-based money creation is dead simply because of the Himalayan size mountain range of debt it created which now spans the entire globe.

Let’s look at some figures and try to quantify in our own minds some of these absolutely outrageous numbers.

I have denoted in bold the thousands through to quadrillion steps with two letter prefixes just so that we can begin to navigate and quantify the truly staggering extent of these numbers…

qu tr bi mi th

$1,000,000,000,000,000 = total notional world derivative value

$300,000,000,000,000 = Global debt [includes Govt, Household, Corporate, Bank

$128,000,000,000,000 = Total Bonds 68%… SSA Bonds 32%… Corporate 68%

$95,000,000,000,000 = Total world stock market

$84,000,000,000,000 = World GDP

$55,000,000,000,000 = Global household debt

$20,953,000.000,000 = US GDP

$11,600,000,000,000 = Market value of derivatives

Total debt as a percentage of gross domestic product 353%

And some other numbers too that might help us gain some perspective on just how far the world is in trouble…

- Cryptocurrencies $244 billion

- Global military spending $1.78 trillion

- US Federal deficit $38 trillion

- FED’s Balance Sheet $7 trillion

- Gold $10 trillion

- Fortune 500 Stocks $226 trillion… by market cap… [not asset value]

- Global Real Estate $280 trillion

- Global Wealth $360 trillion

But do both you gentlemen miss the elephant completely or was it just a case of trying not to offend the gentleman’s club? Then again is it, dare I even say it, simply avoiding any risk of someone ending up looking like JFK, Alfred Herrhausen, or even Colonel Gaddafi… all of whom chose to question the legitimacy of the global privately-owned banking cabal.

For Mainstreet, it makes no odds anyway what the reason is for our financial elite’s status quo habit of never addressing the overarching problem and simply fiddling about rearranging the deck chairs on the financial ship Titanic. It is what it is… in a word they are perfectly at ease in fatcat comfort with their orchestrated state of perpetual neofeudalism. The rentier crony-capitalism reverse socialism model works just fine when you belong to the club.

Whatever the scenario, we are all at extreme risk with the current bubble-blowing reality that could well make 1929 look like a Sunday school picnic by comparison. Classical Keynesian mindset and Central bankers fiddling about with MMP fiscal and monetary tools in this debacle is quite frankly little more than a sad joke.

Expecting a positive result using tools that no longer work would be laughable if the looming shipwreck wasn’t mathematically inevitable. It’s basically using the tactic of trying to fix crippling global and sovereign debt with more debt… brilliant!

I won’t bore the pants off anyone with a tedious regurgitation of what I wrote last week regarding Mr Prebble’s epic confusion on this very same subject… if you want to recap… it has the Tower of Babel picture on it… the 2nd comment from the top of the page. To my absolute horror, there is not so much as a single rebuttal to any of the theories I aired… go figure.

Not only is the fiat system taking its last gasps, but so too the world’s reserve currency which was installed at the end of the 2nd world war in Bretton Woods New Hampshire USA. Here the financial elite of the world muscled in the new blueprint that would, in its various guises, take us right through to the present day where the systemic collapse of the entire world economy is now imminent.

Along the way, the dollar became fiat under Nixon’s regime. The petrodollar version of fiat reigned until last spring when Saudi Arabia signed a new oil/military/security deal with Russia. That was the precursor for the petrodollar going up in flames completely with Putin’s put this month and the announcement of a new trading currency instrument that would be the very antithesis of fiat and not just backed by gold alone, but by some 19 other commodities.

This will be a trade-only currency and made up of a basket of multiple sovereign currencies that are willing partners in this completely new paradigm in trade, reserve and default currencies. The argument is that it should be incredibly stable from the combined effects of multiple commodity backing and as well as multiple sovereign currencies.

Of course, the reason our system is broken beyond repair and facing a meltdown is hardly surprising. In fact, it was baked into the cake no less than 112 years ago.

So at the end of the day, it seems as if it’s all about humanity’s very long train journey. And yet I have a sneaking gut feeling that we are on the final leg. Maybe the latest stretch was a dark tunnel. We are coming around a gentle sweeping corner and suddenly there is a light ahead.

The end of the tunnel looms into sight and it now finally dawns on some of us that what I refer to as the 2020’s Troika might just save a big chunk of the globe. That’ll be Putin, Lavrov and Glazyev and their brand new cooperative currency initiative which any forward-looking sovereign country can use to kick out the old broken system permanently.

Slight problem… NZ is no longer a sovereign nation even in the broadest sense of the term. The last few articles on this blog illustrate this sad reality in a most scary and profound way. Our habitual obsession with Uncle $am’s financial and military might may well end up killing many more of us before we finally begrudgingly see the light.

Cheers