I was recently asked for my 2 cents worth regarding the rapidly expanding BRIICS movement AKA as Zone B or the Global South by a very productive think-tank/geopolitical site based in Costa Rico.

I thought perhaps it may also be of interest to the kiwi freedom and truth movement readers as this subject has not drawn anywhere near the level of attention it deserves in NZ. I view this progress as being of immense importance because not only does it have ~90% (on a population basis) of the countries of the world clamouring to join this bloc, but it offers a life-line that could save a huge chunk of the global economy from a looming and catastrophic western financial meltdown.

The emergence of a new multipolar financial/trading/security paradigm is a global renaissance of epic proportions.

This topic is badly in need of being brought into the public arena. Ignoring this exciting new reality risks isolating NZ from a huge swath of trading partners, economic windfalls, and security opportunities.

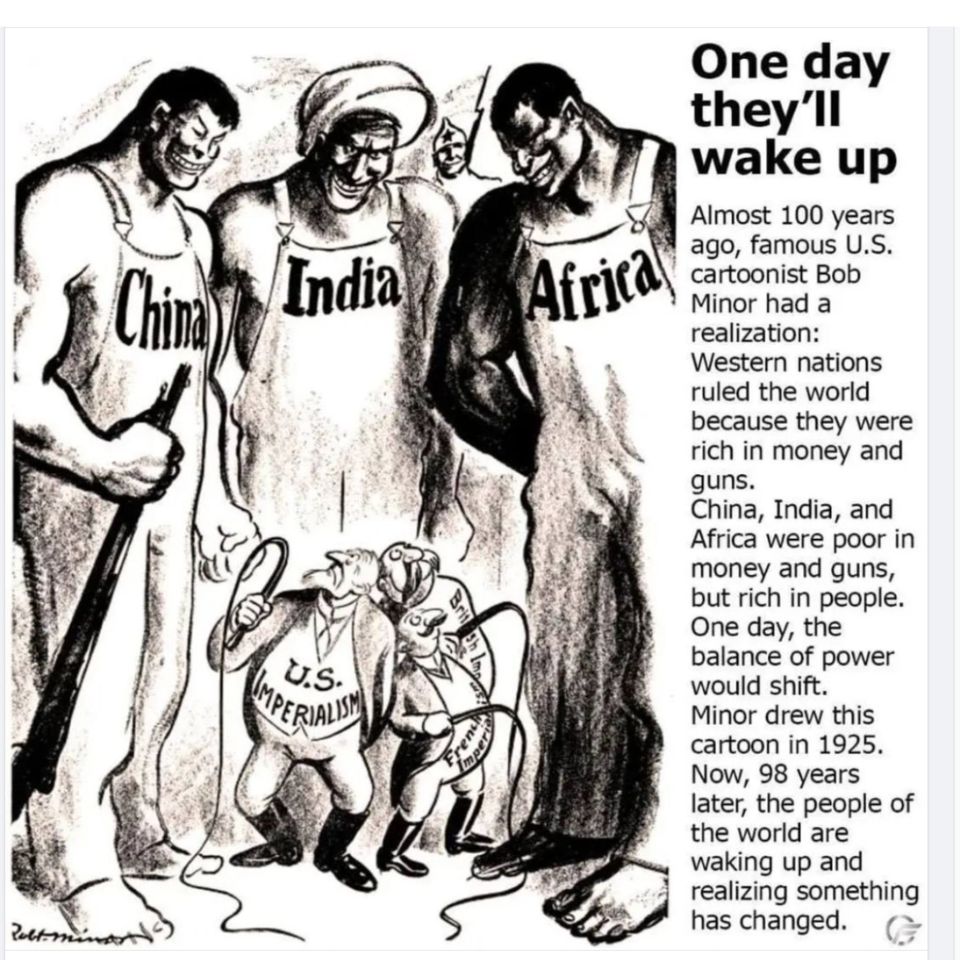

A multitude of epic financial and security events are all converging at once. Amongst the most salient is the West’s own habit of massive self-mutilation. At long last the BRIICS have become fully aware that the western hegemon has fast become its own worst enemy, and that in many instances it is an extremely wise strategy to just stay out of the way and let them get on with their apparent goal of complete self-inflicted mutilation.

*(BRIICS… the original acronym was formed from the letters of the original members Brazil, Russia, India, China, South Africa) although now with both Iran and Indonesia joining the bloc, it is sometimes referred to as BRIICS+)

The development of the BRIICS bloc and its associated Belt and Road initiative is a a huge subject on its own – it is far beyond the scope of this essay. One of the best resources I have seen that gives some insights into this huge development was written by a friend and colleague of mine for an excellent geopolitical blogsite based in Costa Rico. For anyone wanting to familiarise themselves, I recommend the link below an excellent place to start. It is divided into 5 parts; this is part 5, but it contains the links to parts 1-4 as well. The focus is more on Russia/Africa but the whole initiative actually spans the entire globe.

Meanwhile, I am hugely confident that humanity will not be facilitating the emergence of a new predatory global hegemon. It is self evident that the spirit of the giant BRIICS initiatives are the polar opposite of what we are so desperately hoping to be rid of.

I am also confident that neither Russia nor China will seek any real dominance for their respective currencies in terms of a hegemonic style reserve currency. It is very well documented (think Triffin Dilemma) that in the longer term it is simply not a desirable goal for a vibrant and export-orientated economy based on production of real goods and services.

The so-called “extraordinary privilege” is not what it seems, and the ability it gives the host country to sell its debt, tends to have a boomerang effect in the longer term. Given that, especially in the case of the Chinese, the larger non-West entities tend to think and plan in terms of centuries – I expect that these countries will not crave this status.

NEVER PLAY CHESS WITH A PIGEON

“Never play chess with a pigeon.

The pigeon just knocks all the pieces over.

Then shits all over the board.

Then struts around like it won.”

It is clear that the hegemon refuses to be an adult, and is now acting like a pigeon and is very dangerous in the current circumstance.

A VISION OF A NEW FINANCIAL REALTY BASED ON FOUR ESSENTIAL PILLARS

I see the new BRIICS bloc being built on sound humanitarian fundamentals – none of which are in the least bit conducive to fostering a continuation of hegemonic belligerence or malice. NB all of these tools need to be in place together, in order to foster a healthy and sustainable industrial-capital model.

- The spirit of this cooperative bloc will be based on mutual respect, security of all members and a mutual win-win goal for all parties. This way countries can reward all levels of society and invest in long-term wealth projects.

- Banking at all levels, from central bank down, based on public utility models. The only orthodox private commercial banks that would survive in this environment would be those that could competitively operate toe-to-toe with these state, public, and cooperative-owned entities. Those that couldn’t would quickly disappear and their premises could be bought up by the emerging new public utilities. The postal level could probably be accommodated within the existing system and without any need for extra bricks and mortar. Any country that deploys this system would, by definition, neuter the status quo western banking lobby whose goals are always the control of money and credit creation. The corollary of the western model is making sure that a continual state of war is perpetuated as an integral component of their diversionary tactics. Of course, the multi-trillion dollar global war machine is a key component of their entire network, especially in terms of income.

- Transition out of fiat and into hard-backed currencies and trade currency instruments being hard-backed as well. The hard backing will be preferably up to 20 commodities which would give the sovereign currencies, the reserve currency, and the trade currency instrument stability and provide parties confidence to include it as part of their international reserves. This instrument would never be weaponised like the US dollar has been, as that is a compelling reason for parties not to trust it or to even use or hold it as a reserve.

- The final acceptance by the entire bloc that financial capitalism simply doesn’t work, and that all member nations need to be on guard for signs of re-infiltration and to be very vigilant in monitoring signs of fifth and sixth columnists and also budding western orchestrated colour revolutions.

ORTHODOX WESTERN ECONOMICS ARE BASED ON COMPLETELY FALSE PREMISES

I remain appalled at the state of the so-called “science” of economics in the western world, as the entire debacle is based on faulty premises. These were designed into the status quo nurturing system installed in order to protect the private banking sector and to feather the nests of a numerically tiny group of global kleptocrats. This was the case when I briefly studied economics in the early 70s, before I went farming, in my opinion it remains the case to this day.

(See i – iii below).

I have no regrets given the fact that I didn’t carry on with my institutionalised studies past 201 level, as the vast majority of what they were feeding me was nothing more than institutionalised tripe. Even the label “pseudo-science” fails to capture the true extent of how humanity is being led up the garden path by academia with often using utter falsehoods that are, in my opinion, criminally and sociopathically insane.

There are still to this day only a minuscule number of western-based economists that will acknowledge this sad and destructive reality. Michael Hudson is foremost amongst this brave group of individuals. Richard Werner has been iconic in his efforts too. Thankfully a few more are beginning to speak out – another that has become very prolific is Radhika Desai.

Werner* was the first person in a high position to whistle blow on the outrageous monopoly that the global private banking cabal were handed on a plate. Almost the entire western collective of economists has been intent on continuing to hide from the public the extraordinary parasitic theft that the private banking cartel inflicts on humanity.

(i) Orthodox western economic theory completely ignores the role of banking and money creation. It doesn’t account for the fact that round 95-97% of money and credit in the western sphere is created by commercial banks making loans. This is in effect creating money out of thin air using digital entry on a ledger. Indeed, it’s almost as if the role of banking is regarded as purely facilitatory and of no real consequence in terms of directing capital allocation.

By definition, the commercial banking industry has huge sway as to what sectors of the economy loans are advanced into. In this system, the majority of loans are not made to businesses and the real economy, but instead, largely end up in the FIRE* sector. *(FIRE = Finance, Insurance, Real Estate… AKA Financial Capitalism)

These loans are advanced because of the safety of the asset collateral that already exists. This in itself is a huge distortion of economic forces, as a country’s capital allocation is to a large degree under the control of this thieving and parasitic private sector.

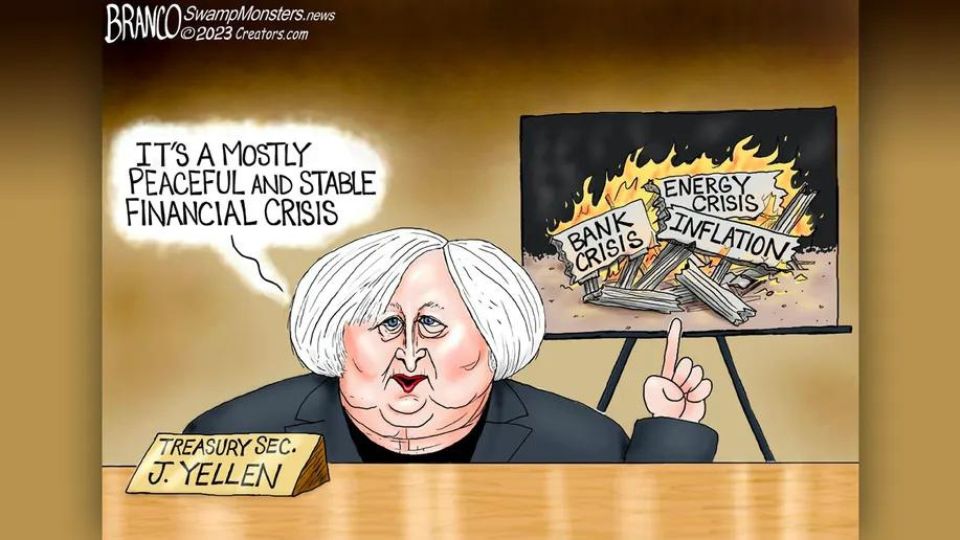

This factor alone is enough to destroy any economy… the absolute classic of course is the U$ situation which is currently technically insolvent at every level, including of course the Fed and the Treasury*. This is because the entire country has strayed so far away from a vibrant industrial capital model, and headlong into self-destructing financial capitalism. With this comes all the trappings of huge financial lobbying, where Govt facilitates rampant crony capitalism, and voters predictably end up with the very best politicians that money can buy. *Both have negative equity… the Fed sits at -$1 trillion and the Treasury a truly mind-numbing -$31 trillion)

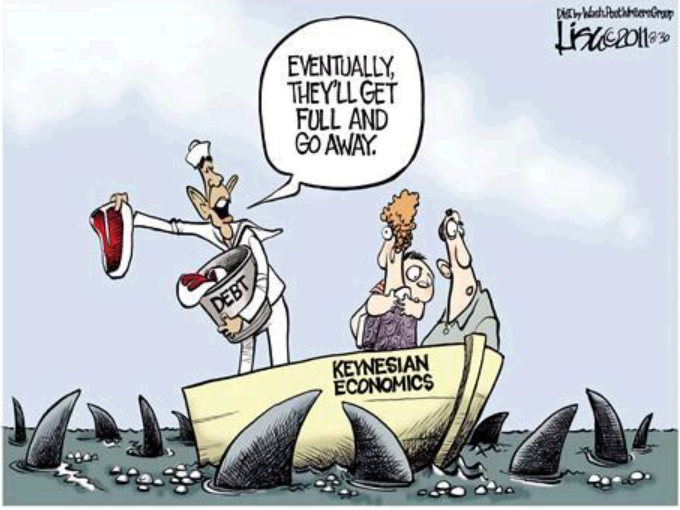

(ii) Western economists are obsessed with Keynesian demand-side theory and pretend that supply-side strategy and its tools for tackling inflation and fine-tuning monetary policy don’t even exist.

It has also been proven that the demand-side crock doesn’t work because of a huge lag effect when interest rates are hiked. Token hikes don’t work, they actually feed inflation until the economy is wrecked by the rate hikes on the way up anyway, or in an economy with low debt they don’t work until interest rates reach or even surpass the true rate of the loss of currency value. Of course in todays massively levered economies the entire financial edifice would completely collapse long before those rates terminal rate were even approached.

The solution that is right under our noses doesn’t involve liquidity squeezes, job losses, and business and personal bankruptcies, if deployed intelligently, it has precisely the opposite effect. Using this method, liquidity is not squeezed, instead, it is funnelled into the productive economy, resulting in adequate money supply and velocity. It results in more goods and services being produced and it has been proven time and again that this method actually brings inflation down!

The status quo system clings onto the demand side tools because this facilitates the private-bankster inspired perpetual cycle of pump and dump events. It also helps blow all the asset bubbles that they use to their advantage in order to continually fleece 99% of humanity.

This western-style crock is what “our” monumentally feckless RBNZ is obsessed with and it gives the giant privately owned commercial banks a free lunch and utterly obscene undeserved profits. This is all orchestrated blatantly at the direct expense of Kiwi citizens, small businesses. and the innovative and entrepreneurial startups that we so desperately need to get our economy humming again.

(iii) Western economists are also fully on board with a situation where the true value of the labour resource is neither recognised nor rewarded. This is what makes the current showdown between the Zone A and B blocs a monumental new paradigm shift in terms of the an immense rethink in the social responsibility for our entire civilisation.

THE CBDC AS PART OF A SOCIAL CREDIT STYLE ENTRAPMENT PLAN

(CBDC = Central Bank Digital Currencies)

The entire spirit of the BRIICS paradigm is to strive for complete financial sovereignty for each member country. Their chosen model will be an individual decision to suit their own unique circumstances – not something that is foisted on them by more powerful members, otherwise the spirit of the entire vision is compromised before it even gets off the ground.

Also, a CBDC, in a system where a central bank is a purely public utility model, will have entirely different ramifications compared to a context such as the US Fed where the CB is totally privately owned, and effectively operates with very loose mandates that are so easily manipulated, undergoes no audits*, and are basically accountable to no one. Furthermore, all oversight is conducted within house*, and the massive regulatory capture basically means they self “regulate” (sic). *(for crying out loud, the last full Fed audit I am aware of was in 1953 – the year before I was born)

Don’t get me wrong, I loathe the concept of any form of CBDC, especially the retail version, because of the power this technology could potentially wield. However, I do think, at least within the Chinese rendition, that it is just another tool of social credit control which potentially helps facilitate what they were already doing anyway. I absolutely do not prescribe to the view that the Social Credit system was designed clandestinely by the Chinese in tandem with the WEF globalists. On the contrary I think it was a system that was already in place and turned out to be something that Klaus ‘Slob’ and his cohorts could opportunistically pinch to insert into their agendas of genocide and eventual complete bio-technocratic control of the masses. Believe me if China was working hand in hand with the WEF, humanity would already be incarcerated in a global techno-gulag. China is the financial nemesis of both the WEF and the western hegemon, and has rapidly become an immense military power as well.

It is my own personal belief that every Kiwi would be doing themselves, and the entire country, a massive favour if they simply took the time out to listen to this interview and to try to comprehend the extraordinary way that almost every aspect of China and its culture has been so disgracefully misrepresented to the collective west.

Carl Zha is an extraordinarily prolific historian who has completed extensive studies on China’s recent and ancient history. The interviewer, Brian Berletic, is an ex-US Marine Corps, independent geopolitical researcher, and writer based now in Bangkok.

This interview is entitled China’s “Century of Humiliation” but quite frankly this title doesn’t even come close to doing this subject justice. The humiliation, rape, extortion, and murder by western imperialists, have origins that run much deeper than a mere century. It has now been ramped up more than ever before as the West has finally realised that China has come of age and will no longer allow itself to be continually raped and pillaged as the globe moves into an entirely new multipolar economic and security reality.

This may just help some of us realise who the real enemy is, and also that when they join in habitual China bashing, they are sometimes being unwittingly recruited by Mr Global so that they actually end up directly supporting the agenda of the real overarching enemy of humanity.

Russia is the military nemeses of same. The fact that China and Russia have become incredibly staunch allies, will be the end of the western hegemon and the WEF agendas combined. The only wildcard now, as the collective west loses horribly (both militarily and financially) is; will they choose to deploy the Sampson option and place at risk the survival of the entire human species?

If you wanted to view what is happening through a Russian lens and to understand the monumental criminality of what the US has wreaked in Ukraine, then I would suggest this documentary compiled by the world renowned historian Oliver Stone. This gives the entire dreadful history of the Nazi presence in Ukraine which infiltrated that country well before the outbreak of WW2. If anyone would like to see compelling evidence of why the RF is humanity’s last hope in humanity’s fight for freedom then this is a damn good place to start.

CENTRAL BANKS TO PLAY A MUCH DIMINISHED ROLE IN THE NEW PARADIGM

My vision is that as these models evolve, the central banking industry will lose its relevance and the Treasury of each country will take over almost all of their monetary duties.

Also, I can’t see how a large shift into retail CBDCs fits with a public utility system of banking, to me the two are patently and fundamentally mutually exclusive. A move into largescale CBDCs for any country is by definition the death knell for existing private banking cartels, as this system makes wholesale banking almost completely irrelevant overnight! As such I don’t visualise CBDCs gaining much traction. The financial kleptocrats have totally mistimed and botched this rollout – this all sounds very familiar doesn’t it. In short they were never going to be able to deploy this plan and at the same time keep their global network of privately owned commercial banks intact as well.

CONCLUSION

The emergence of a new multipolar financial/security paradigm is a global renaissance of epic proportions and an existential battle for both camps. I am appalled that this potentially human species-saving event is not a hot topic in NZ – it is high time this changed before NZ completely isolates itself from a huge swath of global trading partners and future economic and security opportunities.

Col

Written by Colin Maxwell. (A semi-retired Northland based cattle farmer, and geopolitical researcher/nurd specialising in global finance, banking models, and political science… I have around 25-30,000 hours of independent non-institutionalised study and research under my belt)

Excellent mega-post Colin setting the background and a differing perspective on the powers building in the east. It is mind-blowing the BS we in the west are told and I’ve always felt that Russia and China aren’t the bad guys in all this… quite the opposite.

thank you, col, for helping us wend our way through this maze, thank you amarynth for linking to col. there is considerable debate on the implications of putin’s backing the yuan, i’m hoping you might share your take?

No worries emersonreturn it’s what I do.

Re Putin/Yuan… methinks it’s just going to be a progression where the spirit is that they just want to dollarize using any method they can. Neither Russia nor China will crave overwhelming reserve currency status and they will continue to work towards a new international trading-only instrument that the individual currencies will be pegged to.

That new instrument, whatever they end up calling it, should have tremendous security and stability and will of course be hard-backed.

This will avoid the destructive Triffin effect that eventually destroys any dominant reserve currency.

I think this process is developing that fast now that they will develop the final blueprint as things progress.

Lula has his huge 240 5 day delegation in China this week too… so much is happening it’s hard to keep up. Having said that it’s all good news for the BRIICS+ and one kick in the guts after another for Natopstan… how sad too bad never mind.

Cheers

Col

BTW, I am so honoured that you Deb and AHH are the very first three commenters on the new site.

Onwards and upwards… WHOOP WHOOP!!!

“I am appalled that this potentially human species-saving event is not a hot topic in NZ”

Good news bursting out everywhere is being stifled!

Cheers Col

Yep AHH looks like a lot of the heavy lifting is gunna have to be done Downunder by lil old me.

At least I have a big mouth.

LOL

Col

PS… BTW welcome aboard, its an honour to see you here. And you will

notice I took the liberty of linking your fantastic articles in this essay.