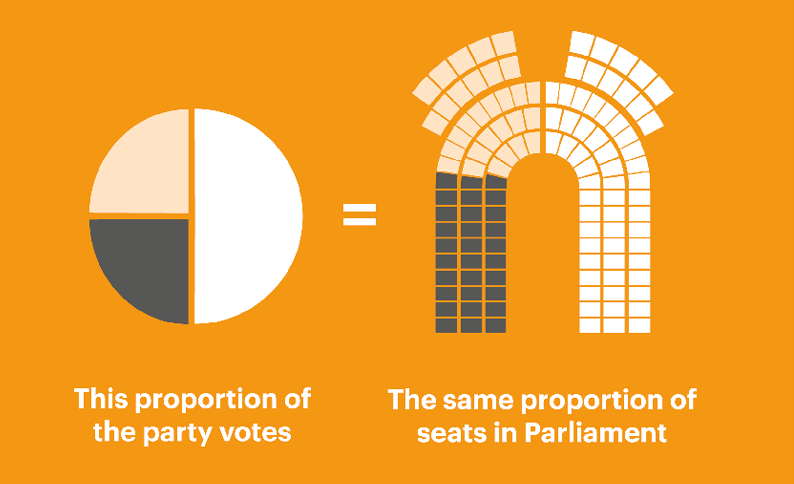

It is sad to see the degree of confusion out there in regard to how the system works and leading into the most important election in NZ history. With this in mind, I have outlined my interpretation of MMP maths .

I invite critique and input as to what I have wrong and what could be added – this is what I wrote as a brief summary of MMP maths below…

CONFUSION IN NEW SHEEPLAND over the workings of MMP

The maths is surprisingly simple because there are 120 seats in total – including 72 electoral (each representing ~50,000 votes) and 48 Party seats.

The 5% threshold figure is the same as dividing the 120 by 20, meaning that once a party reaches this % of votes they automatically win 6 parliamentary seats (120 divided by 20 = 6).

If that party won no electoral seats then all of their 6 seats would come from their nominated party list.

If they won 1 seat they would be topped up with 5 from the party list.

If they won 2 seats they would be awarded 4 from the party list.

Winning 3 seats they would get 3 of each – right up to if they won 6 electorate seats, then they would not need any more party seats.

Each party prior to the election must provide a nominated list of party member rankings.

As soon as a party wins 1 seat it no longer has to meet the 5% threshold and if NZ Loyal won a seat it would get another MP by winning 0.8% of the total vote. It then goes up in increments of 0.8%:

0.8% = 2 MPs

1.6% = 3 MPs

2.4% = 4 MPs

3.2% = 5 MPs

4.0% = 6 MPs

etc…