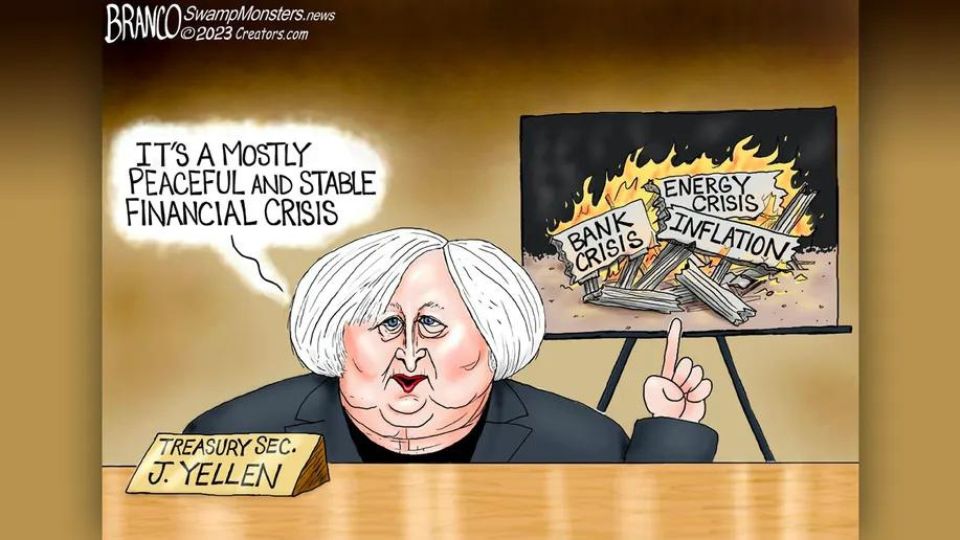

Isn’t it sickening listening to all of these ex-spurts including, NZ’s (sic) Minister of Finance and even the Crash Test Dummy in the White House droning on about how safe their banking industries are?

And notice there is no mention anymore of the Cyprus-style deals that NZ signed on to in an internationally binding bail-in agreement. These meant major haircuts for unsecured creditors (depositors) in bank failures and the gamblers and derivative holders being the #1 ranked creditors. The silence on this is deafening.

Also, there are all sorts of other dodgy tricks out there too, like CoCo bonds, where if there is a liquidity crisis they are converted to equity, in the form of allotting plummeting shares to replace bonds, when the shit hits the fan.

This isn’t being talked about either, and it really amounts to a way for the bank or institution to keep solvent by seizing bond assets and converting them into equity. In this way, bondholders can end up with a major haircut too.

I’m waiting for the financial derivative market to go tits up now. This will go around the world like wildfire and with Deutsche Bank and J P Morgan having the biggest exposure that will cause the meltdown to go globally systemic.

These banks habitually have derivative books north of $50 trillion – yes that’s a big fat T! Just these two banks combined have nominal derivative books significantly higher than annual global GDP.

The horrible little garden gnome look-a-like, NZs MOF, can lie to us until he’s blue in the face about how safe our banks are, but all the big ones are largely owned by the dodgiest TBTF (Too Big To Fail- yeah pull the other one) banks and corporations on the planet. No amount of insurance schemes are ever going to save this situation once the dominoes start falling.

The common equity Tier 1 capital requirement for banks in NZ is ~4.5% – so how will this look when the property bubbles burst and people also withdraw their deposits and their equity goes negative almost overnight – a double whammy to their balance sheets. Collateral collapses when asset bubbles pop but the debt loaned against those assets remains.

Everything the central banks are doing is bullshite… monetary tweaks ain’t gonna rescue this one – a global systemic meltdown is baked into the cake.

Their collateral value is totally fictitious and the equity ratios of all of the big banks are pathetic before the true value of their collateral is even properly revealed by market crashes.

This meltdown is going to make the 1929 debacle look like a walk in the park. It’s the same entities in behind it too. These thieving plutocrats are well-practised at giant pump-and-dump cons – it’s an integral part of our trade. And yet the RBNZ and the Govt play along with it.

Same too in the comparison of 2023 to 2008…

- In 2007 unrealised losses in investment securities in federally insured U.S. banks during the 2008 financial crisis were less than $75 billion.

- At the end of the fourth quarter of 2022, the unrealised losses were over $600 billion – a whopping 800% higher

There is not a single valid reason for this current sudden ramp-up in interest prices and they will not address our CPI crisis either. It’s simply more pillaging by the financial sector at the expense of our society.

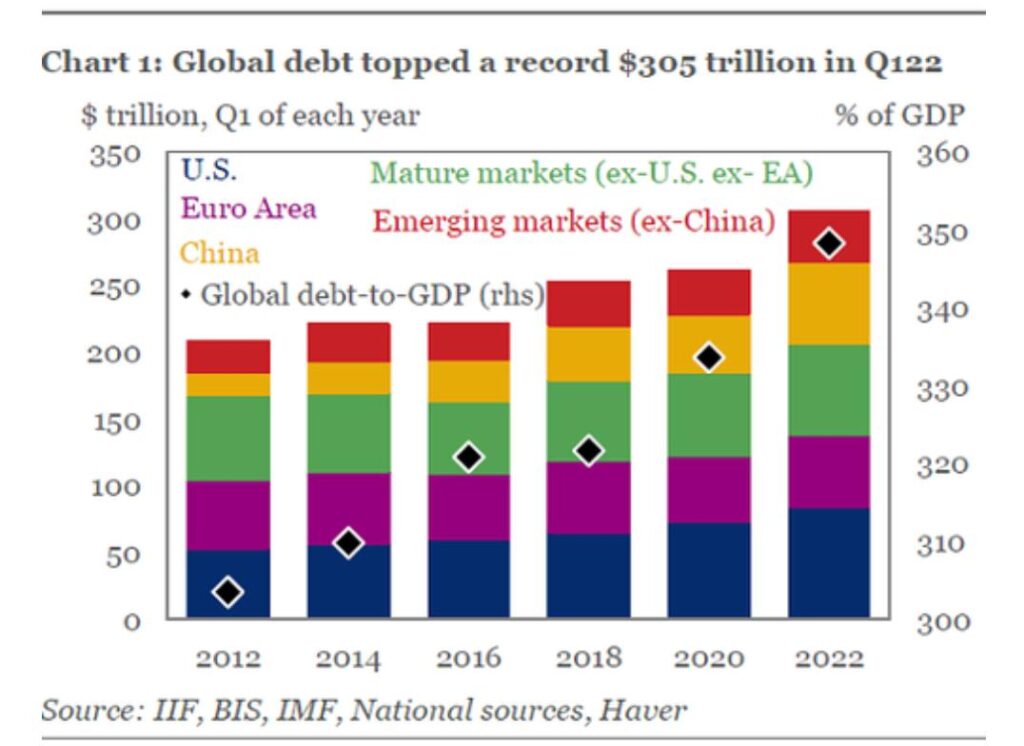

The chart shows global debt at >350% of GDP and tells me that the western sector of the global economy is technically insolvent.

But the really revealing thing about the chart is that China and the emerging markets only hold a relatively small % of this total debt despite their huge population.

This is why the meltdown shouldn’t affect the BRIICS+ bloc anywhere near as badly as the West – especially if they all get their act together and default on all predatory western debt. It’s full-on hybrid war anyway so they have every reason to default.

The vast majority of the debt is held by the US, Euro area, and other mature western markets, AKA pretty much Natostan!

I have a strong gut feeling that within a year the US will have major states and even blocs of states succeeding and forming their own independent republics. That will be the end of Uncle Slaughter.

The EU will also inevitably disintegrate because their model is totally broken too. Wait until the real truth about the Ukraine debacle and the motives behind it really comes out – that will be the end of the EU, UK, and NATO.

Methinks it’s very much a case of ‘Once Upon a Time in the West’ now, as the entire charade gets set to blow. It’s the same old story… the sun never set on the British Empire either… until it did.

Cheers

hello, col, a few days ago on globalsouth you asked if anyone had news of zoltan pozar. i left a post which i hope you noticed but if not i thought i’d follow up. zh posted a paywalled article of his from GoldFix. apologies if you’ve already read it.

Thanks Emersonreturn