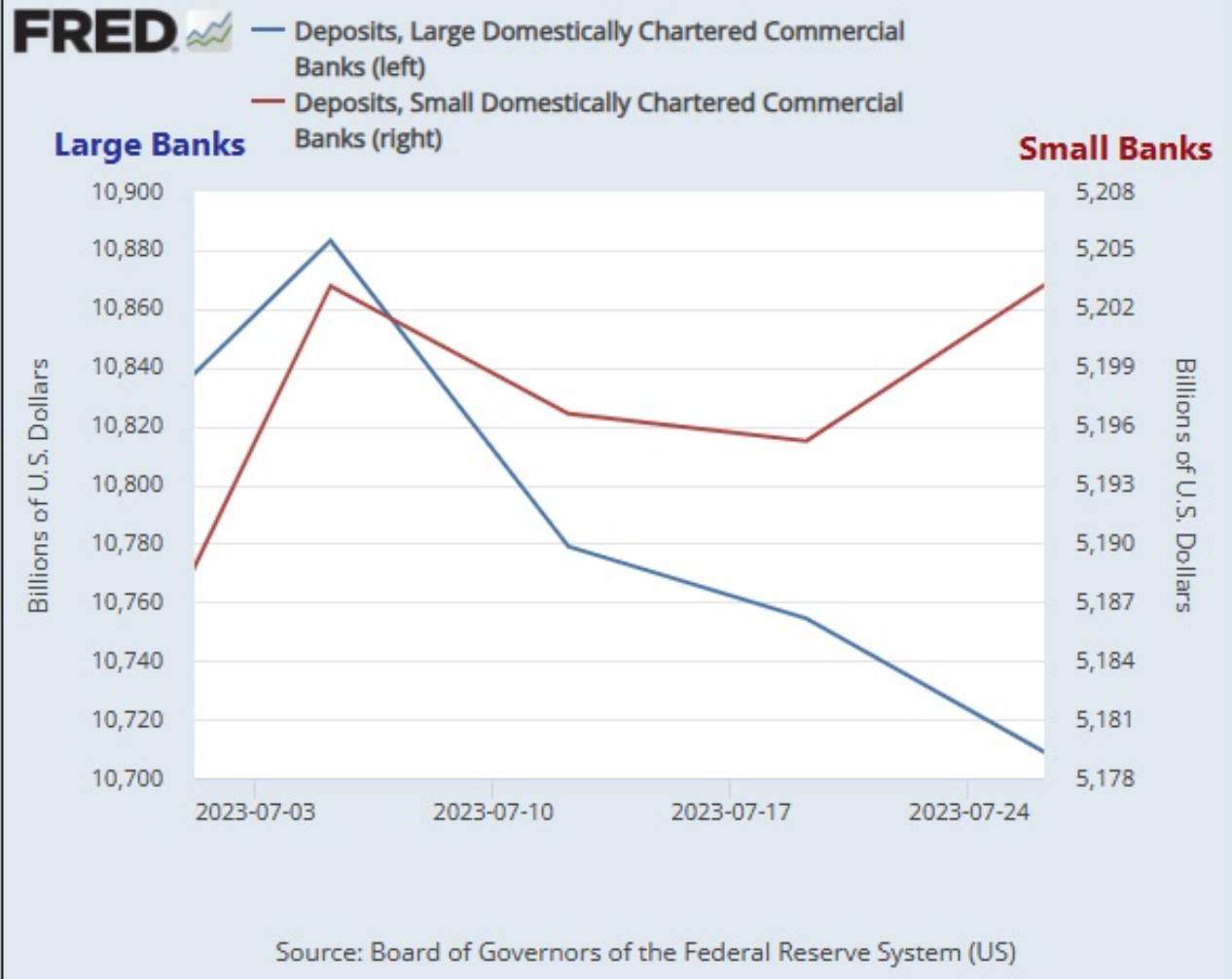

We are being sold a bunch of baloney when we are told that depositors are seeking out the perceived safety of the largest banks. On the contrary, it has actually been the smaller banks that have staged a comeback since the week of April 26 – see graph.

Paraphrased from the following article The 25 Largest U.S. Banks Are Seeing the Largest Fall in Deposits in 38 Years With No Signs of Letting Up:

The fact that 4 U.S. domestically chartered commercial banks have deposits of more than $1 trillion means it is important to monitor what is happening, especially since one of these banks Citigroup blew itself up in 2008 and subsequently received the largest Fed and treasury bailout in history.

Meanwhile, serial felon JP Morgan Chase was allowed to feast on the carcass of failed First Republic Bank even whilst being charged by the Attorney General of the US Virgin Islands for actively participating in Epstein’s sex trafficking for more than a decade!

The Eleventh Circuit Court of Appeals called what the U.S. Department of Justice allowed to happen to these girls “beyond scandalous” and “a national disgrace.” And yet, the U.S. Department of Justice has left it to the Virgin Islands to bring civil charges while it remains missing in action on bringing criminal charges against JPMorgan Chase.