In fact, it is the most obscene example of reverse socialism that humanity has ever witnessed.

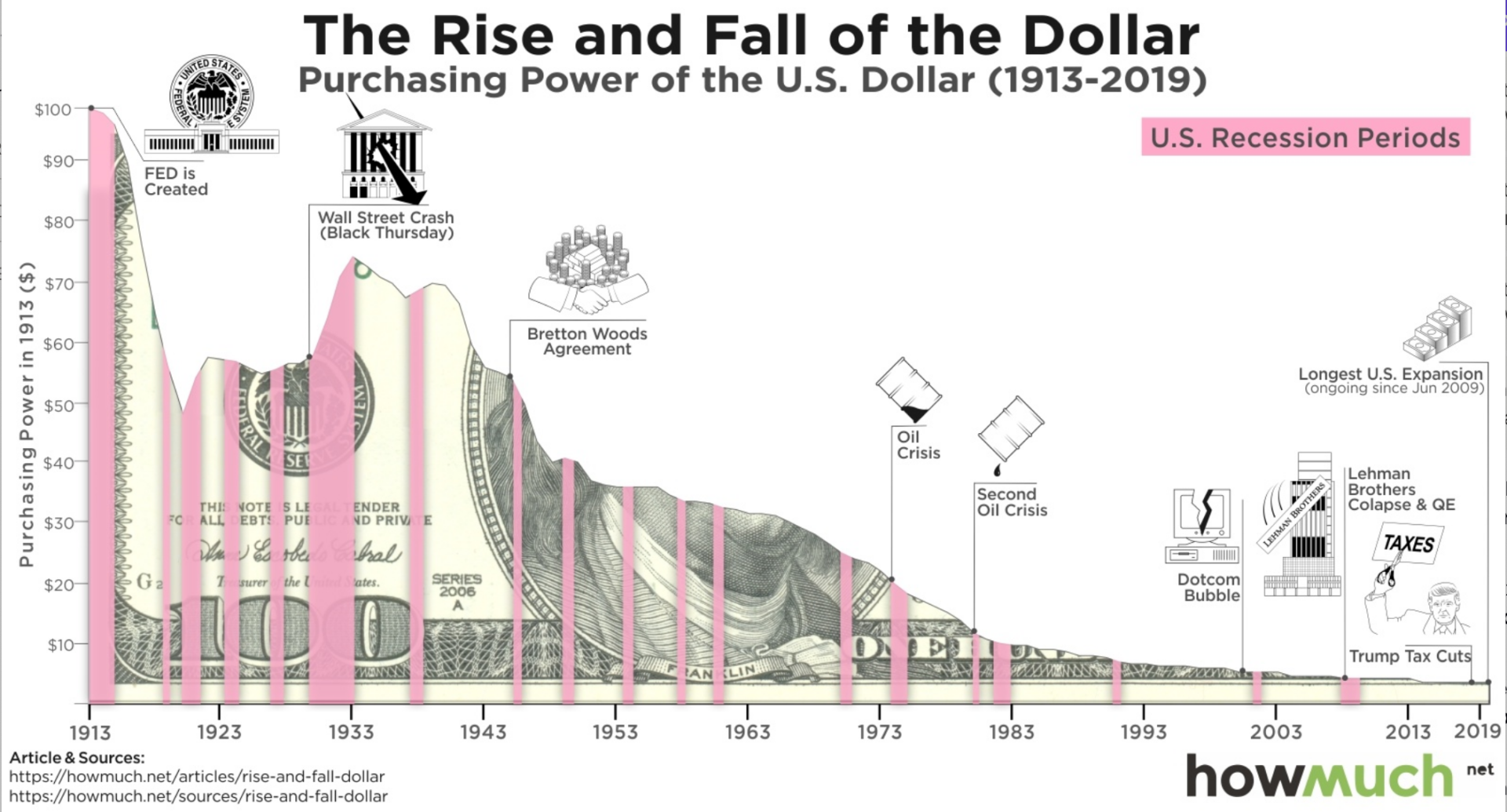

The scene was set for this debacle to unfold right back in 1913 as a result of a clandestine meeting of private banksters convened on Jekyll Island – an article I wrote on this subject.

To quote Robert Reich…

America is now a hotbed of socialism. But it’s socialism for the rich. Everyone else is treated to harsh capitalism.

Robert Reich

That quote is from an article Robert Reich: Socialism for the Rich, Capitalism for the Rest written by Reich in 2019 when Trump was POTUS, although it describes a situation that really kicked into top gear when Nixon took the US dollar off the gold standard in 1971. Since that date, the casino fiat currency economy has morphed into a Frankenstein-like monster that provides the perfect breeding ground for the most obscene form of reverse socialism ever to exist in the history of humanity.

This is not about left or right

Going back almost 70 years to the days of Eisenhauer there have been six Presidents from the so-called “left” (Democrats) and six from the “right” (Republicans). During this entire period, the reverse socialist system has been nurtured and developed by both parties and to the exact same extent that they each have grown the MIC (Military Industrial Complex) that has turned the US economy into a perpetual war machine. The entire economy would collapse were it not for the fact that the US has been at war during that entire period. By definition, a perpetual war economy is also a socialist economy, and in the case of the US, it is once again reverse socialism on an extraordinarily blatant level.

Reverse socialism goes hand in hand with Neoliberalism and this is what has taken the Western world by storm to the stage where there are extreme examples of fascist-style neoliberalism emanating from all colours of the political gamut. The archetypical current example is the US financial model where their central bank is 100% owned and manipulated by thieving financial kleptocrats.

The FED was wrong footed

The good news though, is that all of this subterfuge is now unwinding at a massive rate, especially with the Basel III NSFR Tier1 +2 rules which kicked in at the beginning of 2023. The idiotic FED was wrong-footed by these new regulations with their extremely badly thought-out gold fixing attempts in order to try to protect the dollar.

The FED has now fallen completely out of sync and favour with other global Central Banks and especially with the BIS (Bank of International Settlements). The FED has been desperately trying to slow the conversion of paper into physical gold and this has greatly helped competitor banks and central banks that are long and strong on gold.

Meanwhile, the FED is desperately trying to unwind its muppet-like suppression attempts and is also trying to claw back disastrous bets against PM (precious metals). Worse still, just before the rule change, they threw in a massive paper supply and borrowed physical bullion warrants from the BIS (Bank of International Settlements). The BIS at the same time covered all ~500 tons of their 2022 paper gold liabilities to zero just before the rule change. As such the FED was totally wrong-footed.

It was basically a situation where the Basel III update turned gold into a Tier1 asset – this was a paradigm change that left the FED out on a limb. This change is huge because up until the end of 2022, there was a 50-year coordinated western central bank attack on physical gold prices which has now disintegrated.

The BIS changed its behaviour totally from that of the FED because they are so much more aware of the reality of the new global situation with the emergence of hard-backed sovereign currencies within the massive new BRIICS+ bloc. The FED appears to have no clue about this massive development and as a result, they will now be thrown under the bus as they still hold significant bearish bets against gold.

As I understand it, under Tier1 +2 rules, an institution has 2 days to deliver under NSFR (Net Stable Funding Ratio) regulations – I only wish they now have to have the physical supply backup to operate. The weakness of the FED with a dwindling supply of physical gold puts them at the mercy of much more savvy competing central bank buyers of physical.

Add to that the fact that all these overseas entities are extremely keen to swap their depreciating US dollars into gold. Misled speculators have been wrong-footed too, and wise long haulers are holding on and can no longer be rinsed out of the market because the long-term strength of PMs is virtually guaranteed.

The imminent banking crisis adds extra momentum to the flight to gold as a safe house too – this adds to the Tier1+2 driver. All the while it is important to remember that this is not gold going up in value – it is the loss of purchasing power of fiat whilst the so-called “timeless relic” buys almost exactly the same goods as it did 2000 years ago on the streets of Rome.

BRIICS+… another massive incentive for 90% of the world to de-dollarise

The new gold/commodity-backed currencies of the huge BRIICS+ realm are now coming of age and are perfectly able to provide liquidity for much of the global energy and commodity markets. Swaps and goods-for-goods bartering reduce the need to hold reserves of any currency, let alone the all set to implode US dollar token.

The blatant and unbridled 50-year manipulation of global gold and silver supply ended Dec 31 2023. In effect, the system of using paper to convert a physical gold bar into an unbacked paper fiat gold just went up in smoke, just as the petrodollar completely burst into flames too.

Now if you want to play the game of PM speculation you must hold physical or you are better off disappearing quietly into the night. In essence, the FED has now completely lost what was left of its global credibility and they face the reality of a host of subprimes around every corner that will make the 2008 GFC (Global Financial Crisis) look like a pimple on an elephant’s backside.

The US dollar’s dominance as the global reserve currency is now in free fall as its rate of decline in the last 12 months is running at 10x the rate of the last 20 years. From 73% in 2001, down to 55% in 2021, and 47% in 2022. It is in such steep decline now that it is impossible to predict where it will be by year’s end.

The defining moment for this crash was in February of 2022 when around $300 billion of Russia’s overseas foreign exchange was supposedly frozen by the US. They effectively announced to the entire world that it is not safe to hold reserves in US dollars unless you are going to accept their imperial hegemonic rules.

The comical part of all of this is that of the €250 billion held in Europe they have only been able to locate €33.8 billion. Technically these reserves still belong to the CBR (Russian Central Bank), as under international law a country has to make a formal declaration before doing so of course, the EU and its member nations, have absolutely no intention of doing this as they know full well that they are no match for Russia.

What the US has effectively done is to have destroyed the faith in their currency in terms of global reserve status by pillaging a pitiful €30 billion from Russia. It’s much worse than that too, because as other countries divest out of dollars, literally trillions will now flood back into the US, with disastrous effects on their currency and as a direct consequence their ability to fund imports.

Given that foreign-owned US currency is 18.4 times domestically owned foreign currency this poses an enormous risk too, as this potential dollar selling by foreigners dwarfs the ability of US buyers to absorb this sell-off by liquidating those relatively tiny amounts of foreign money.

This leaves only their ESF (Exchange Stabilisation Fund) to help but this in turn would reduce broad money supply when there is already a massive problem caused by liquidity contraction. Or the FED might ask for cooperation through swap-line partners to buy dollars and sell their own currencies in return, but this would be highly inflationary too.

The US Govt Debt (Treasury debt) already sits at $31 trillion which in physical gold terms, at US $2000 per ounce, is a mind-boggling 440,000 tons – this amounts to more than double the entire global tonnage mined in world history (~208,000 metric tons). This will never be paid back in a hundred years and with current trends, this debt will balloon out even more disastrously.

Both the FED and the Treasury are technically insolvent. The only tool they have at their disposal to treat any of this debacle is to print more money which only leads to more inflation anyway. If they keep interest rates where they are, or hike further, they will protect the dollar but they will further destroy the real economy which will lead to the systemic collapse of the entire system.

Printing more dollars and easing interest rates will take them back to the very same circumstances that killed the real economy in the first place. There is absolutely no way out of this collapse now and the entire debacle is completely self-inflicted, being caused by insufferable greed, and complete mismanagement of every single aspect of the national economy.

The perils of CRE investments and even of cash itself

The next challenge that looms in this crisis is in CRE (Commercial Real Estate) as this giant bubble pops because of a massive oversupply of commercial buildings, particularly high-rise housing rentals and office space – this will also force the FED to cut rates to try to avoid any mass carnage and bankruptcy.

The perils of the flight of bank deposits into short-term money markets will also be exposed as investors can wake up one morning to find that their funds are suddenly subject to bail-ins.

Even moving into cash is risky because as a depositor you are a completely unsecured creditor to the bank. All these moves into more liquid investments, and even cash itself deposited in institutes, are essentially high-risk.

Derivatives

Derivatives are arguably the biggest gorilla in the room of all, and I believe this situation has the potential to bring down the entire Western House of Cards. This gravity of this subject alone requires a separate article – suffice to say here that total global derivatives (notional value) are probably sitting somewhere around 2.5 Quadrillion which is roughly 30 times the annual global GDP – this is a time bomb just waiting to explode.

The 2008 and 2020-23 crises are two very different animals

In 2008 bank credit was collapsing so dramatically that it was never going to feed straight into inflation.

In 2020 bank credit was still really strong and growing early that year. In the ensuing period much of this money supply went directly into consumption which was always going to feed inflation. It also fed asset bubbles even further, and a minimum entered the real economy – which is the one place it should have gone in order to try and stop the rot within the US economy.

Of all the grim statistics that tell us just how serious the current situation is, it is arguably the trend in unrealised losses in investment securities of federally insured US banks that are the most alarming when making comparisons between the years 2008 and 2023. In 2008 the figure was $75 billion, and by the 4th quarter of 2022, this had risen to $600 billion. This is a mind-numbing 800% increase. These unrealised losses will explode even more as the everything bubbles begin to burst.

Total world debt as a percentage of GDP sits at around 350%, which makes the collective global economy technically insolvent, and utterly incapable of recovery without massive debt jubilees. The good news is that a relatively small portion of this debt is held by emerging markets and China – especially when you consider this debt within the context of their massive population.

If you check the US debt clock https://www.usdebtclock.org you will see that the average debt per US citizen sits at a mind-numbing $559,000. If you related this debt to taxpayers it would be north of $800,000 per person.

The US Debt to GDP ratio is 134% and historically no country has ever escaped out of a disastrous permanently debilitating debt spiral once they get anywhere near the 100% threshold. Unfunded liabilities are over $187 trillion which is around 750% of GDP. Meanwhile, the Crash Test Dummy (Biden) assures us that everything is just fine and dandy for the shining city on the hill.

Neoliberalism and the disastrous effects of reverse socialism will be utterly exposed in 2023 – barely 1/3 of the way into the year, and I would hazard a guess that we are already at the beginning of a systemic Western financial meltdown. This entire charade will be akin to the fable about the Emporer with no clothes – it ain’t gonna be pretty.

Cheers